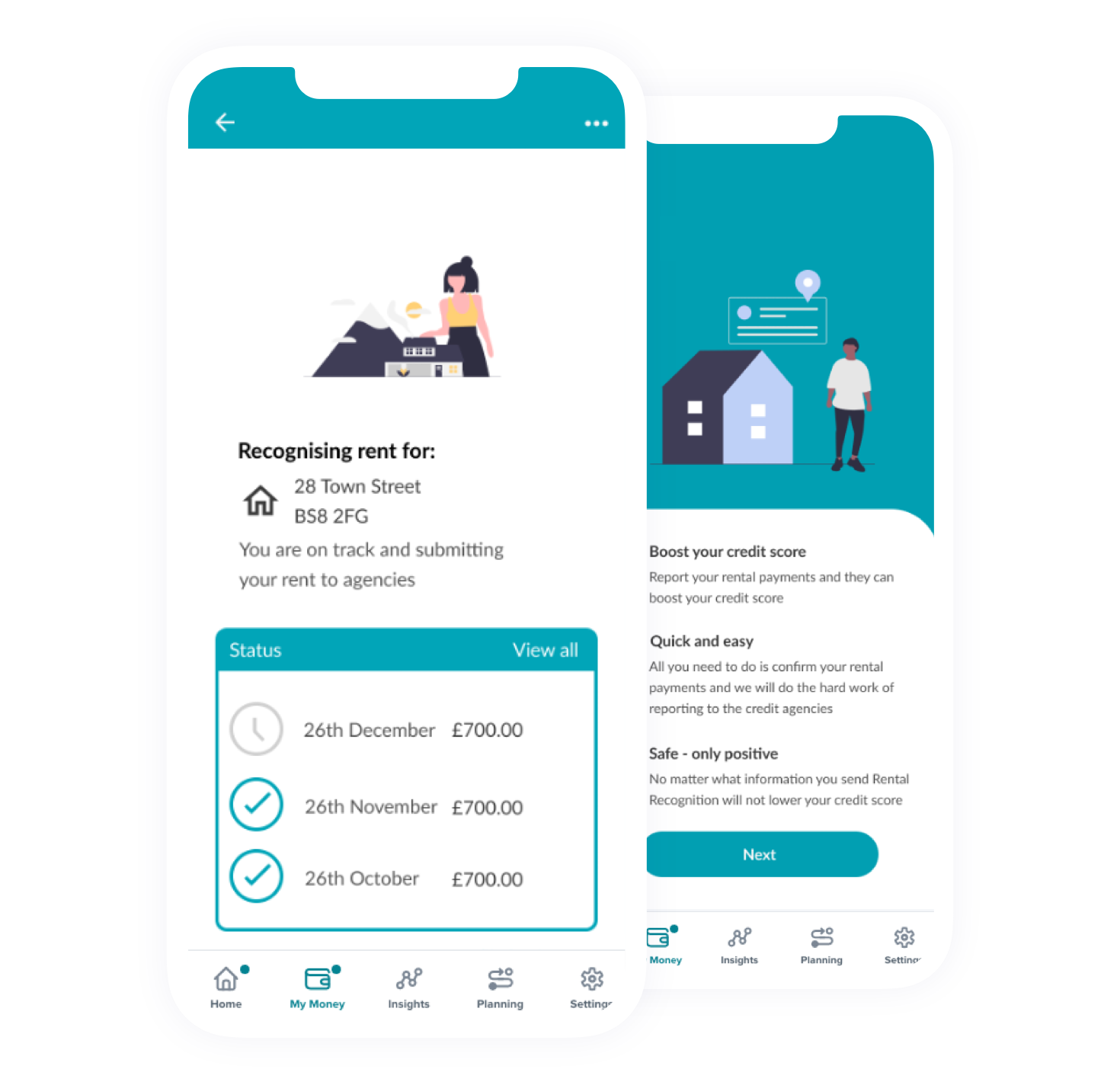

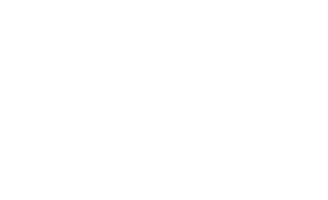

Rent Recognition

API RECIPE

Help customers who have a lack of credit history improve their credit profile and get access to the financial advice they deserve.

Help customers who have a lack of credit history improve their credit profile and get access to the financial advice they deserve.

More than 5 million people in the UK are overlooked and counted out, due to their “thin credit files” (the lack of historical data inform a credit score). They continue to be miss out on financial opportunities, with advice being expensive and cost of living continuing to climb.

As lenders, you can broaden your scope of data by using Open Data to see potential customers' historical rent payments. This provides a more accurate and reliable depiction of their true affordability, reducing your risk and increasing the number of customers who financial journey you can support.

The access to customers' rental payments now enables customers' to demonstrate their ability to repay debt, supporting their application for a mortgage, helping them get on the property ladder and progressing financially.

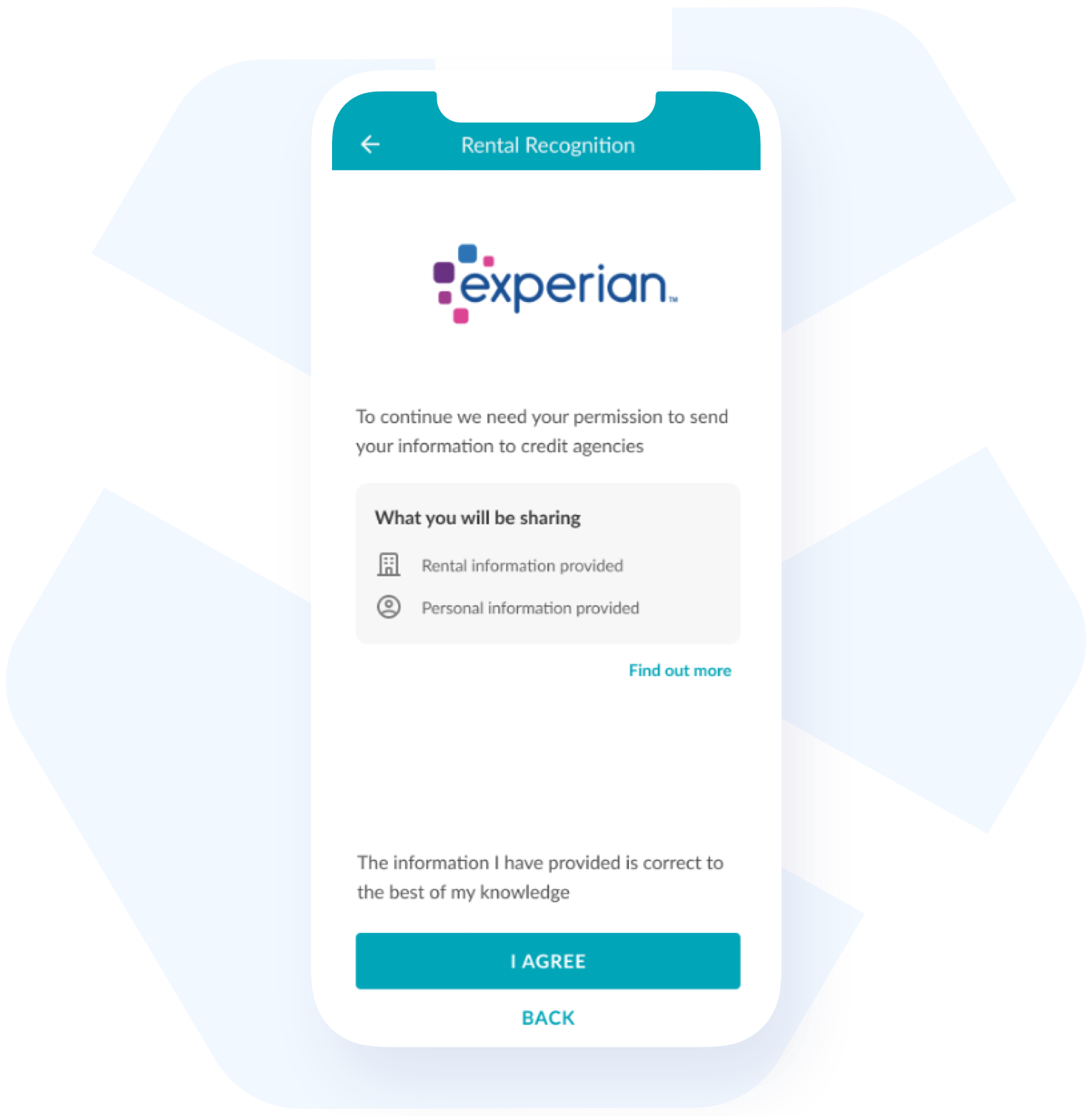

To ensure we capture all financial data, we pull all accounts into one view through our Open Banking API

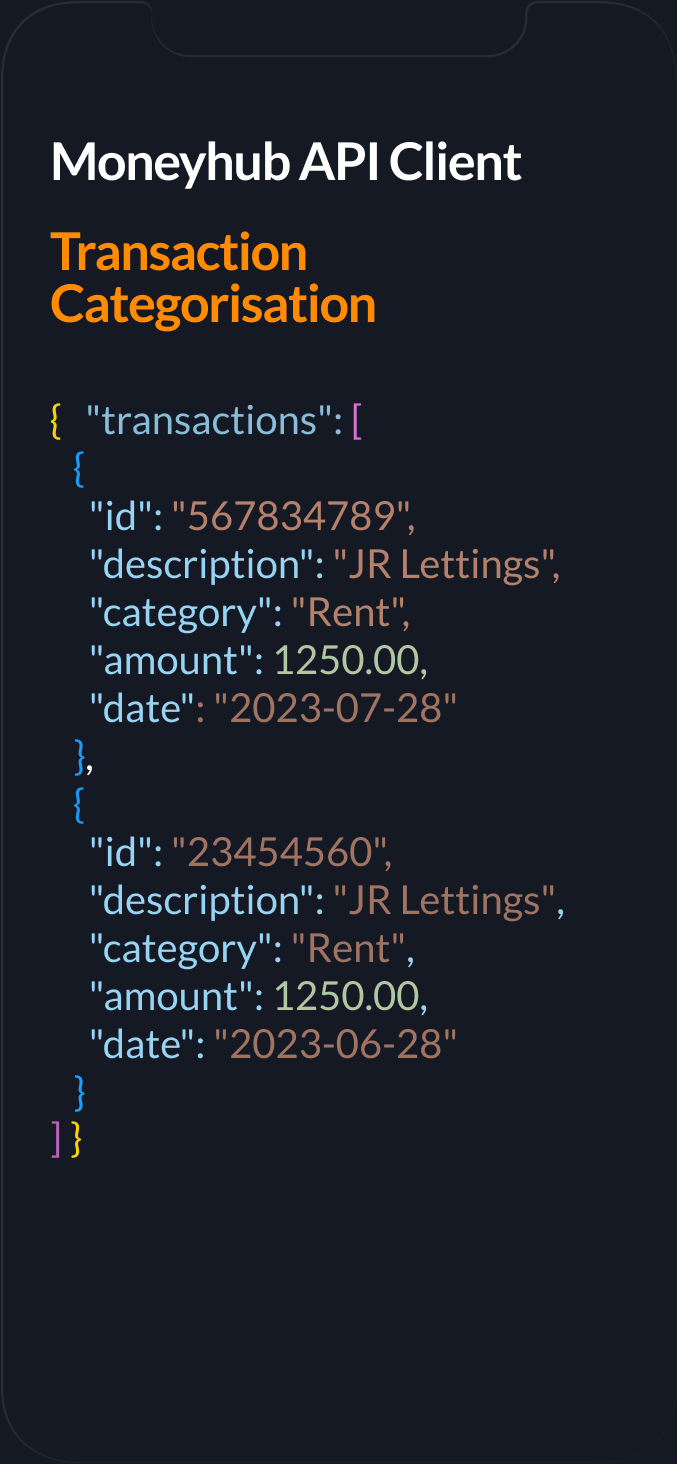

We then assign a category to all transactions

‘Rent’ will be assigned a category

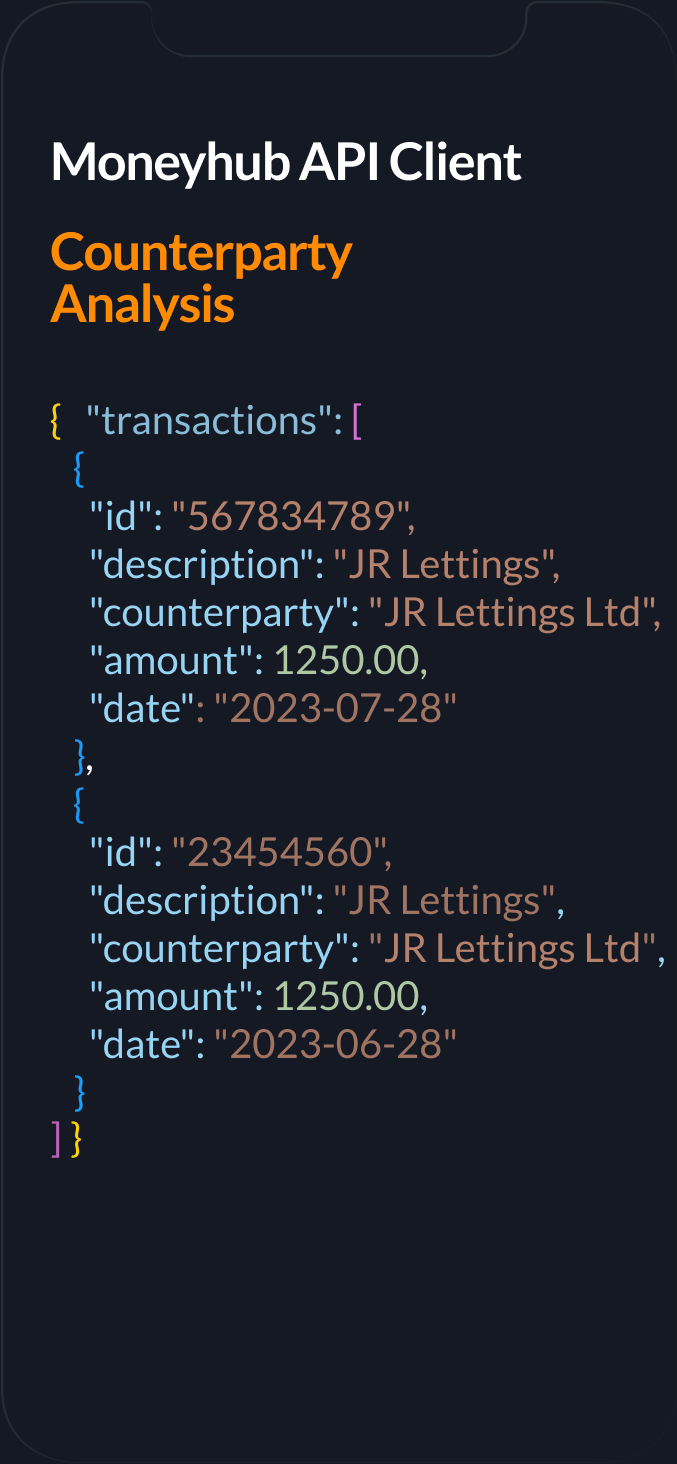

Our platform detects counterparties for all of the transactions that a user has

This helps identify any potential risk of other parties defaulting on the rental payments

Rental payments are detected as regular transactions when the frequency, description and amount are sufficiently aligned

Sam Seaton, Moneyhub CEO

Jonathan Westley Chief Data Officer, Experian

Have a look at our documentation or send along to your tech team.

It can be reported to credit reference agencies to be included into credit score

It can be used in credit/lending decisions

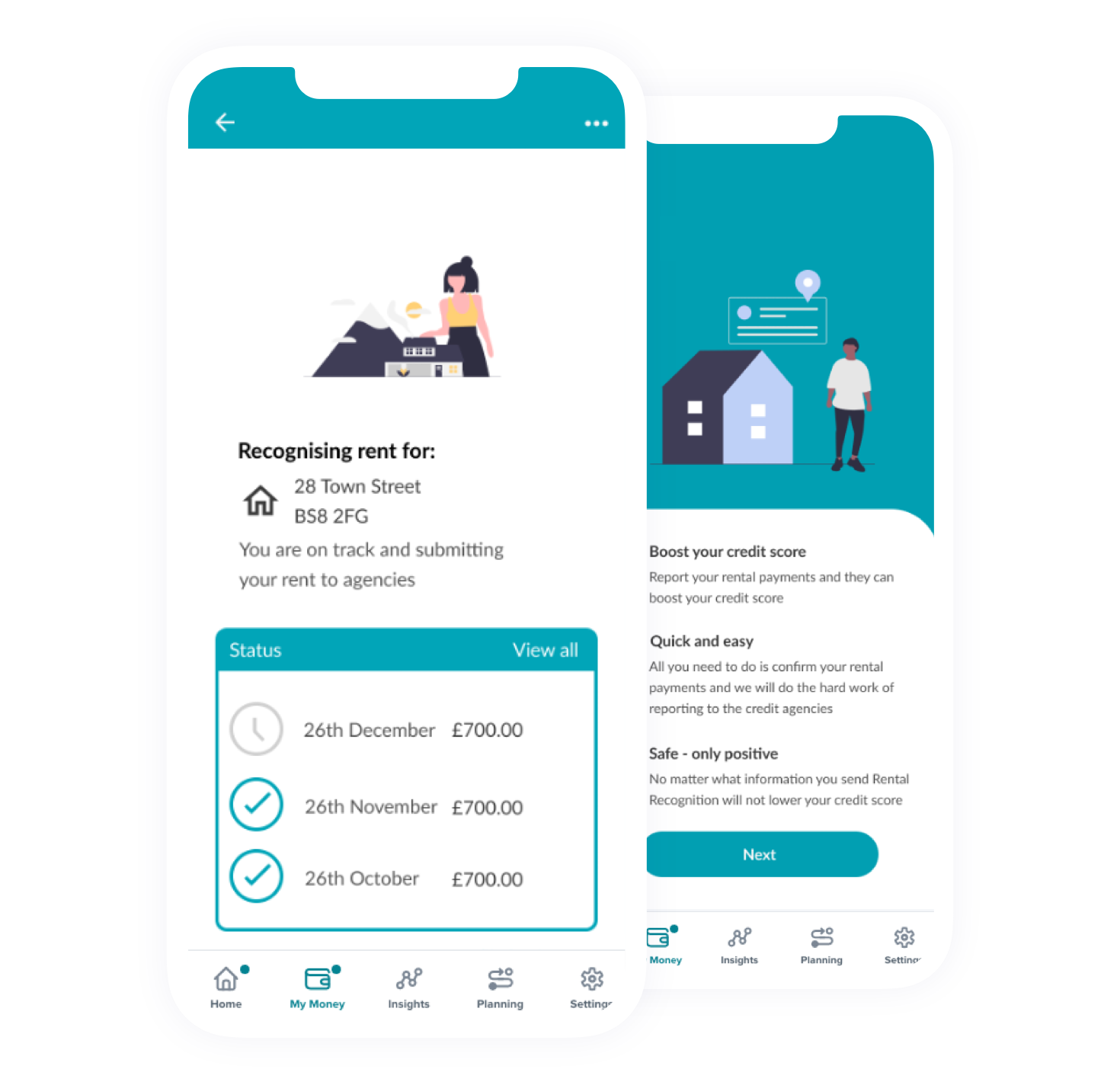

We can report it for you (which requires an agreement in place with the credit reference agency)

Alternatively, you can report it to your the credit rating agency directly

We identify rent payments through our categorisation engine

Additionally, you can invite your users to set up their own rent record to identify the payment (via Open Banking connections rather than manually-added accounts)

To ensure accuracy, we have over 75 data quality checks and 20 legitimacy checks. If a record does not satisfy further validation, the record will not be submitted.

On the 6th of each month, the service parses all rental records creating a report detailing the state of each record. Using both Moneyhub's and Experian's requirements, a record will be assigned one of six statuses for that month.

More info is available within the docs

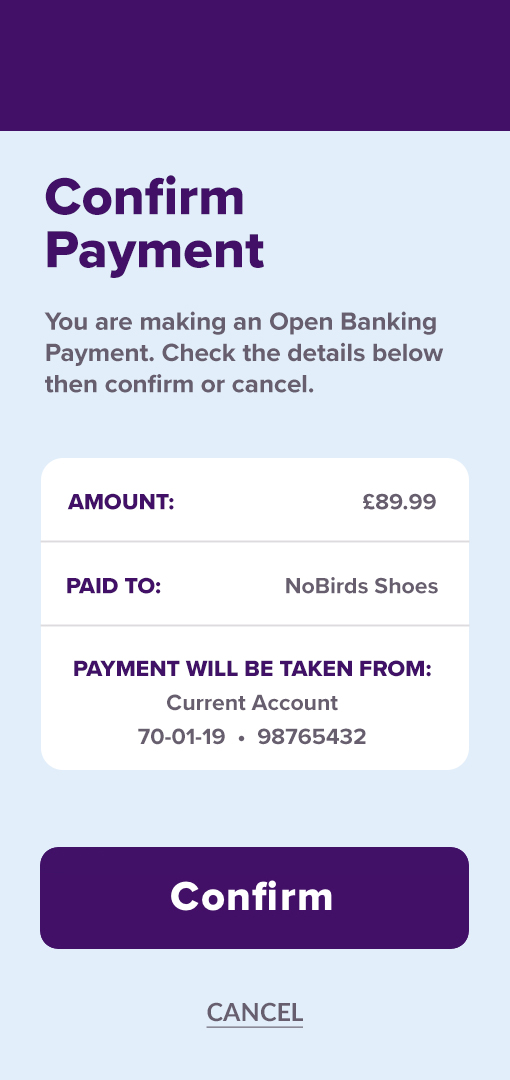

First, where data is presented to your customers through the web or app, FCA permissions is required. This can be through yoru own ‘Payment Service Directive (PSD) from the FCA. Or, we can support you through the Moneyhub Partner Programme, providing you with the necessary permissions through this ‘agency’ approach.

Second, a contract with the Credit Reference Agency is required

Whether you want to create your own solution, or you want us to do it for you — we have the technology for it. Our experienced team is here to support you now and in the future.